✂️🚀 Trim and Turbocharge

FIRE BTC Issue 57 - Why cutting $800/month saves you $240,000 instantly

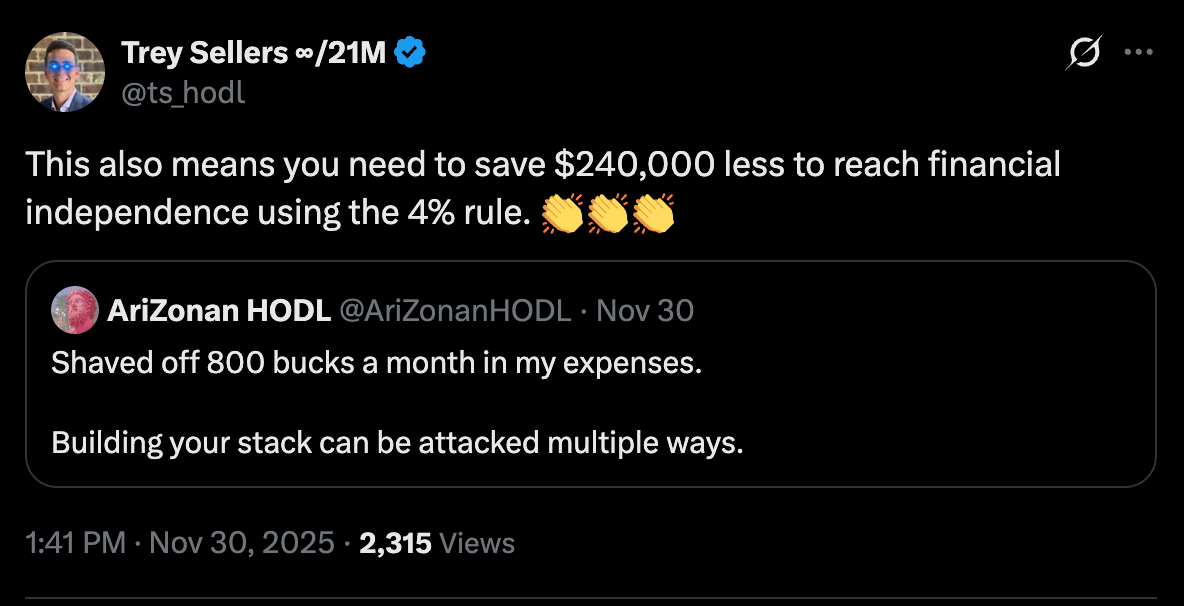

I love seeing posts like this:

Shaving $800 a month off your expenses seems great on the surface, but it’s even better than you think. When people see “cut $800/month,” the reaction is usually, Nice, that’ll help a bit. They don’t automatically see “need to save $240,000 less” or “reach FIRE years earlier.”

We tend to underestimate the power of cutting expenses, not because we’re careless, but because the change feels tiny on the front end. Each cut you make may feel like just a trim—a tweak, a rounding error in the bigger picture.

But if you flip the telescope around and look from the other end, you’ll notice that each “small” expense has a large multiplier attached, making it significantly harder and longer to reach FIRE. Every month you keep it is like strapping on a rucking backpack and pushing the finish line farther away.

If your goal is financial independence, paying close attention to your expenses is a lever you can’t afford to ignore.

🔭 How spending affects your FIRE number

Cutting expenses often gets framed as deprivation—annoying, boring, “frugalist” behavior that steals joy from the present. The default mindset is, Just let me enjoy my life; I’ll figure the rest out later. Because of that, a lot of people don’t take the expenses side of the FIRE equation seriously enough.

But each expense has a magnifying effect on your FIRE number, drastically increasing the size of the savings portfolio you need to walk away from work.

By contrast, every dollar you cut reduces that number, and the effect is massive. The 4% rule (which I covered in detail here) works like this:

Your FIRE number = Annual spending × 25

That means every $1 of annual spending you eliminate reduces the amount you need for financial independence by $25. In the $800/month example, you’re not just saving a bit of cash; you’re changing the size of the target significantly:

$800/month = $9,600/year = $240,000 less you need to save.

This is a time-altering decision.

Most people miss this connection. It just doesn’t register.

For a lot of us, cutting feels annoying, spending feels normal, and FIRE becomes something that happens solely as a function of compounding. In reality, that mindset makes the journey harder and the goal significantly more distant than it needs to be.

You’re not just spending today’s money. You’re spending tomorrow’s freedom.

⚙️ A two-lever approach

Once you realize how spending controls the size of your FIRE number, the second lever becomes available. Cutting a recurring expense doesn’t just make the target smaller; it frees up cash you can redirect into assets. This combination is where the real acceleration takes place.

Think about what happens if you stop spending that $800/month and invest it instead. Suddenly, you’re no longer just reducing the number you have to hit—you’re feeding your compounding engine.

Over a 20-year window, that redirected cash can go into a broad stock index compounding at, say, 10%, or into bitcoin compounding at 25%. We don’t need perfect forecasts to see the shape of this; we just need to understand the direction of the leverage.

Run a simple comparison over 20 years:

Scenario 1 – Do nothing. You keep spending the $800/month. Your FIRE number stays $240,000 higher, and you never invest that money, so there’s no additional compounding. This is the slowest possible path.

Scenario 2 – Cut the $800/month. You immediately remove $240,000 from the savings portfolio you need. Your FIRE date jumps forward just from shrinking the target.

Scenario 3 – Cut and invest. You take that $800/month and invest it for 20 years. At 10% (S&P 500), the future value is roughly $605,000. At 25% (bitcoin), it’s on the order of $1,960,000+ depending on compounding assumptions.

In Scenario 3, you’ve done two things at once: removed $240,000 from your FIRE target and built and grown your stack by hundreds of thousands to millions more than otherwise. The gap between doing nothing vs cutting-and-investing is an entirely different life.

Lever 1: Cutting spending shrinks your FIRE number by a 25x multiple relative to the expense.

Lever 2: Redirecting the freed-up cash accelerates compounding at whatever rate your assets can earn.

Bring the finish line closer and accelerate toward it at the same time. Powerful.

🌎 Move your world

Seeing the mechanics makes it obvious that you are risking significant lost time by not taking your expenses seriously and cutting where you can.

When someone says, “It’s just a small expense—it won’t matter,” what they really mean is that they’re looking only at the front of the telescope. On the front end, $800 feels like a minor lifestyle choice.

But the cost isn’t just the dollars you spend. It’s the years you delay ownership of your time…years you could have already had, years you could have spent differently, years you don’t get back.

Spending is a decision about the size of your FIRE number. Every recurring expense either inflates or deflates that target by a 25x multiple. When you cut waste and redirect those dollars into assets, you’re compressing the distance between you and freedom.

Bitcoin fits into this framework as a velocity amplifier: same two levers, higher potential slope on the compounding side. But the core idea holds even with modest returns.

Paraphrasing Archimedes:

Give me a lever long enough and a place to stand, and I shall move the Earth.

So find the fat and trim it. You’ll add to the length of your lever and accelerate your journey to FIRE.

BONUS

Knowing the math is one thing; actually finding the money is another.

It’s easy to look at your credit card bills and think, “I need all of this.” But you probably don’t. Most of us are bleeding cash in the same 3–4 invisible places.

For paid subscribers, I’ve included “The $800 Cut List” below.

It’s a tactical checklist of the 5 specific areas where I look first to harvest cash for the portfolio—and exactly how to stop the leaks without living in a cave.